The self-described tariff man may already be causing a rethink inside the C-suite about how much long-term capital is invested in building property, plants, and equipment — more formally known to investors as capital expenditures.

A new analysis of fourth quarter earnings reports from Goldman Sachs chief economist Jan Hatzius found that S&P 1500 companies hiked 2025 capital expenditure expectations by 5% sequentially. But the revision drops to only 2% for a basket of companies Goldman tracks with broad exposure to tariffs. Capital expenditure plans were revised down 1% for companies with a high reported share of sales to Canada, Mexico, and China.

Mentions of tariffs by management on earnings calls jumped well above levels seen during president Trump’s last trade war, Hatzius found.

“Company commentary highlighted the uncertainties introduced by tariff policy and their potential to delay or suspend investment decisions,” Hatzius said. “Companies with greater tariff exposure raised their inflation expectations disproportionately, though our aggregate tracker of price announcements only increased modestly on net and remained well within its pre-pandemic range.”

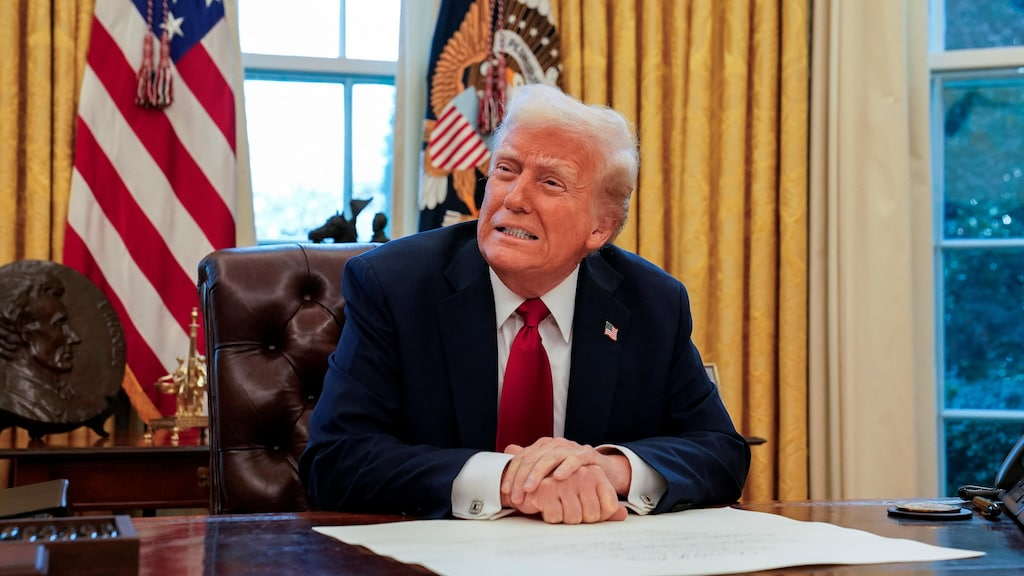

The Trump administration has flooded the zone with tariffs in the first few weeks in office.

Trump has pledged to put reciprocal tariffs into place pending an April 1 report from Commerce Secretary Howard Lutnick. The premise is that the US would raise its tariffs on foreign items to match what other countries slap on US products.

“For many years, the U.S. has been treated unfairly by other Countries, both friend and foe. This System will immediately bring Fairness and Prosperity back into the previously complex and unfair System of Trade. America has helped many Countries throughout the years, at great financial cost. It is now time that these Countries remember this, and treat us fairly — A LEVEL PLAYING FIELD FOR AMERICAN WORKERS,” Trump wrote in a weekend post on social media platform Truth Social.

The administration has already levied a 25% tariff on all imported steel.

The president has imposed a 10% tariff on all Chinese imports on top of existing tariffs on the country. China retaliated, placing tariffs on select chips and metals.

Trump recently agreed to pause 25% tariffs on Canada and Mexico for 30 days.