Boeing is set to launch as early as Monday its plan to raise more than $15 billion in capital.

The planemaker was closing in on a plan to raise around $15 billion with common shares and a mandatory convertible bond as it sought to bolster finances worsened by a crippling ongoing strike.

The new capital is set to come from a mix of the sale of stock and convertible preferred shares, the source added, saying the total amount raised could rise based on demand.

Boeing declined to comment on Sunday.

Bloomberg News reported the expected timing of Monday’s capital raise earlier.

Last week, machinists voted nearly two to one to reject Boeing’s latest offer seeking to end the strike that has halted 737 MAX production.

The company said earlier this month in regulatory filings that it could raise as much as $25 billion in stock and debt with its investment-grade credit rating at risk.

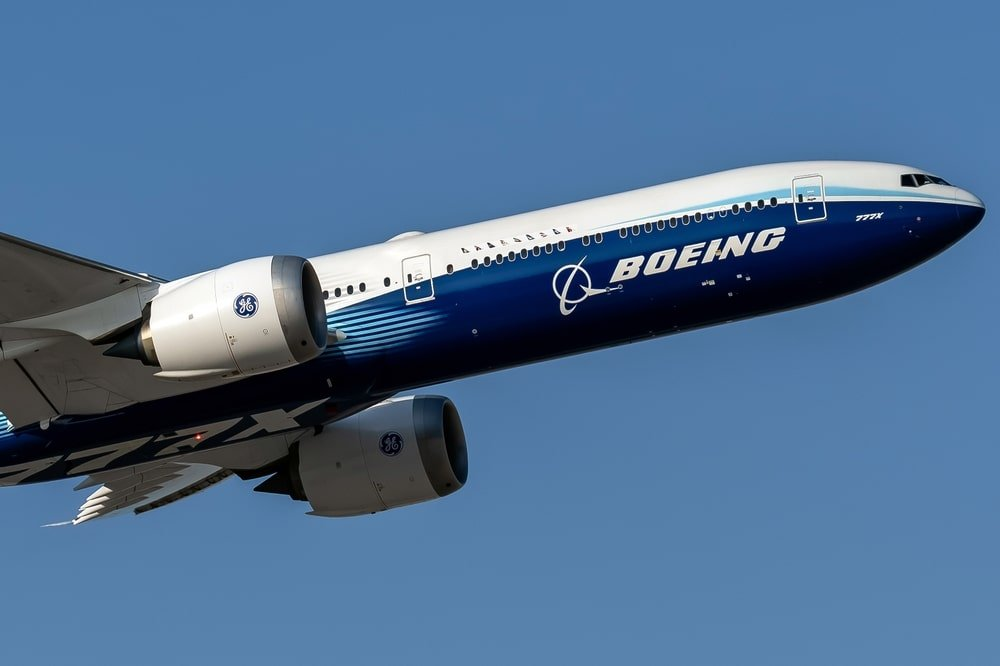

The aerospace giant has been dealing with increased regulatory scrutiny, production curbs and a loss of confidence from customers since a door panel blew off a 737 MAX plane in midair in early January.

Boeing has been burning through cash all year and last week announced a new $6 billion quarterly loss. Earlier this month, Boeing said it had secured a $10 billion credit agreement with major lenders: Bank of America, Citibank, Goldman Sachs and JPMorgan.

Boeing said earlier this month it would cut 17,000 jobs – 10% of its global workforce – and delay first deliveries of its 777X jet by a year.

The top three credit rating agencies – S&P, Moody’s and Fitch – have said they will cut Boeing’s ratings to junk if it raised new debt without retiring some $11 billion of debt maturing through Feb. 1, 2026.