Boeing has offered to acquire Spirit AeroSystems in a deal funded mostly by stock that values its 737 fuselage supplier at about $35 per share, citing people familiar with the matter.

That offer is worth about $4.08 billion, based on Spirit’s outstanding shares as of May 7.

The per-share offer represents a premium of nearly 6% over Spirit’s stock closing price on Monday and a 22.4% upside to its closing price on Feb. 29, the day before Boeing’s takeover talks became public.

Spirit’s shares slid 6.3% to $31.30 in premarket trading on Tuesday. Boeing’s shares dropped about 1%, which would reduce the value of an all-stock offer.

The U.S. planemaker switched its offer from an all-cash one and while the final terms of the latest offer are still being discussed, it could include a small amount of cash, adding the deal is expected to be announced within a matter of days.

Spirit said in a statement that it remains “focused on providing the best quality products for our customers”.

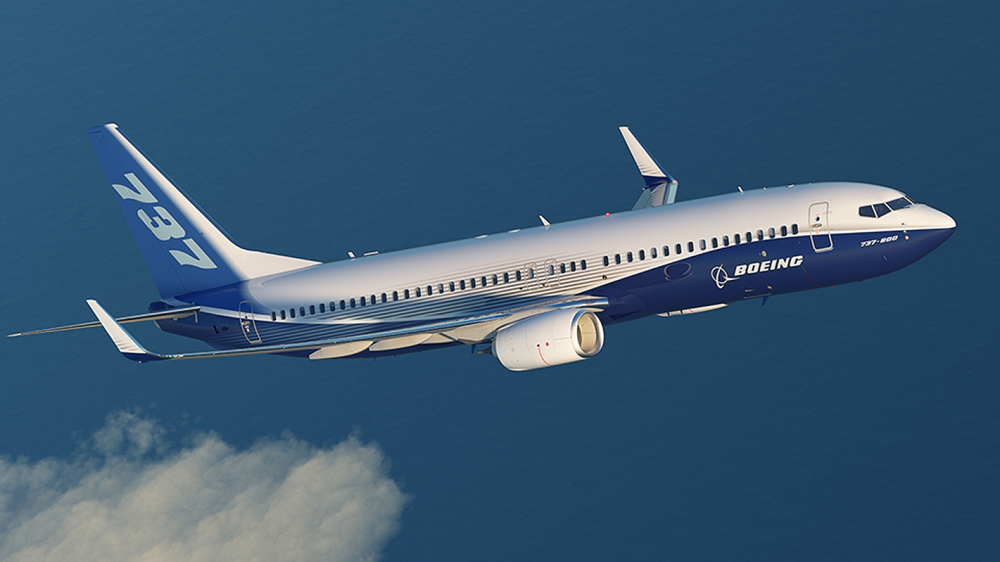

Boeing initiated talks earlier this year to buy back the Wichita, Kansas-based supplier it spun off in 2005, seeking to stabilize a key part of the supply chain for its strongest-selling jet following a mid-air blowout on a new 737 MAX in January.

However, talks hit a stumbling block over Spirit’s work for Airbus, with the European group threatening to block any deal that involved Boeing building parts for its newest models.

Boeing and Airbus have broadly succeeded in dividing Spirit’s programs into work that Boeing will take back, along with work that the Airbus will take.

Still, Airbus, on Monday, lowered its widely watched forecast for plane deliveries this year, which CEO Guillaume Faury blamed, in part, on the uncertain outlook for Spirit’s industrial commitments.