Portillo’s 26.7% return over the past six months has outpaced the S&P 500 by 17.7%, and its stock price has climbed to $15.30 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Portillo’s, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re happy investors have made money, but we’re swiping left on Portillo’s for now. Here are three reasons why you should be careful with PTLO and a stock we’d rather own.

Why Is Portillo’s Not Exciting?

Begun as a Chicago hot dog stand in 1963, Portillo’s (NASDAQ:PTLO) is a casual restaurant chain that serves Chicago-style hot dogs and beef sandwiches as well as fries and shakes.

1. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

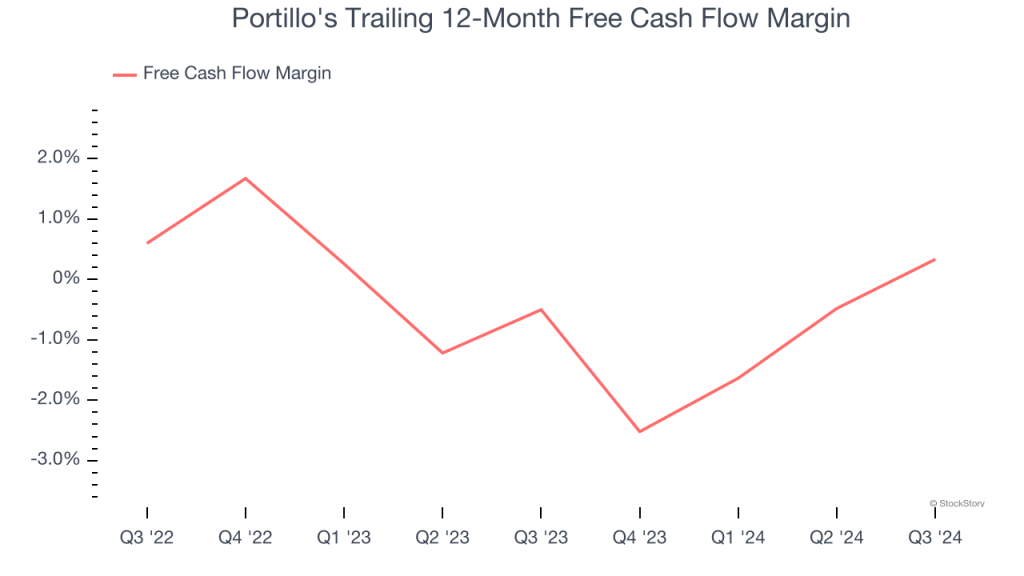

Portillo’s broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

2. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Portillo’s historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5%, lower than the typical cost of capital (how much it costs to raise money) for restaurant companies.

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Portillo’s $575.7 million of debt exceeds the $18.52 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $105.7 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Portillo’s could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Portillo’s can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.