Market Dynamics and Forecasts for the UK, Italy, Spain, and GCC Countries

ForexFlash - The Nvidia share price has been a focal point for investors globally, including regions like the UK, Italy, Spain, and the GCC countries. With its cutting-edge advancements in AI and semiconductors, Nvidia has managed to capture the attention of traders and investors, making its stock one of the most actively watched in the financial markets.

Recent Performance and Market Sentiment

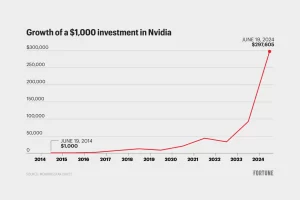

The Nvidia share price has experienced significant volatility over the past year. After hitting record highs, the stock witnessed a correction driven by broader market concerns and sector-specific challenges. Despite this, Nvidia remains a dominant player in the tech sector, with a strong foothold in the GPU market, which is crucial for gaming, data centers, and AI applications.

In the UK, the appetite for tech stocks like Nvidia remains robust. Investors are particularly interested in how Nvidia’s strategic partnerships and acquisitions, such as the recent ARM deal, could influence its share price trajectory. Similarly, in Italy and Spain, retail investors have shown increased interest in tech stocks, driven by a growing awareness of digital transformation trends.

Nvidia Share Price and the GCC Market

In the GCC countries, where investment in technology and innovation is a strategic priority, Nvidia’s share price movements are closely monitored. The region's sovereign wealth funds and institutional investors are keen on diversifying their portfolios with high-growth tech stocks like Nvidia. Moreover, the expansion of AI and cloud computing initiatives in countries like the UAE and Saudi Arabia aligns well with Nvidia’s core business, potentially boosting its stock demand in the region.

Key Factors Influencing Nvidia Share Price

- AI and Semiconductor Demand: Nvidia’s leadership in the AI and semiconductor space is a primary driver of its stock performance. The ongoing global chip shortage has highlighted the importance of companies like Nvidia, making its share price highly sensitive to supply chain developments and demand fluctuations.

- Geopolitical Risks: The Nvidia share price is also affected by geopolitical factors, such as US-China trade tensions and regulatory scrutiny in key markets. Investors in the UK, Italy, Spain, and the GCC are particularly cautious about how these factors could impact Nvidia's growth prospects and stock valuation.

- Financial Performance and Outlook: Nvidia's quarterly earnings reports are critical in shaping market sentiment. Strong revenue growth, driven by data center and gaming segment performance, has been a positive catalyst for the Nvidia share price. Investors are keenly watching how the company navigates challenges in the semiconductor supply chain while capitalizing on emerging opportunities in AI and machine learning.

Forecasts and Investment Strategies

For traders and investors in the UK, Italy, Spain, and the GCC, the Nvidia share price offers both opportunities and risks. Analysts suggest a cautious approach, emphasizing the need for a diversified portfolio strategy. For those with a higher risk appetite, Nvidia remains an attractive buy, particularly on dips, given its long-term growth potential in high-demand sectors like AI and autonomous vehicles.

The Nvidia share price is a significant indicator of tech sector trends, not just in the US but also in international markets like the UK, Italy, Spain, and the GCC countries. As the company continues to innovate and expand its footprint in critical technology domains, its stock is likely to remain a compelling option for investors looking to capitalize on the digital revolution.

By closely monitoring the Nvidia share price, investors in these regions can better navigate the complexities of the tech stock market, aligning their strategies with the evolving financial landscape